How to Establish Ownership Percentages for an Offering

The Articles detail the steps for determining the ownership share each Limited Partner and General Partner will receive based on their contributions, investments, or roles.

How to Add Investor Classes for LPs and GPs

- Navigate to the Portfolio section.

- Select the desired Offering.

- Access the Offering Information section.

- Add the relevant Investor Classes and Name these classes according to the definitions in your legal agreements..

In the example shown in the screenshot, Class B, designated for General Partners (GPs), has its visibility set to "No Users." This setting is crucial as it restricts Limited Partners (LPs) from accessing Class B during the investment process, ensuring confidentiality. However, General Partners (GPs) retain the ability to track their payouts linked to this class.

How to Include General Partners in the GP Class

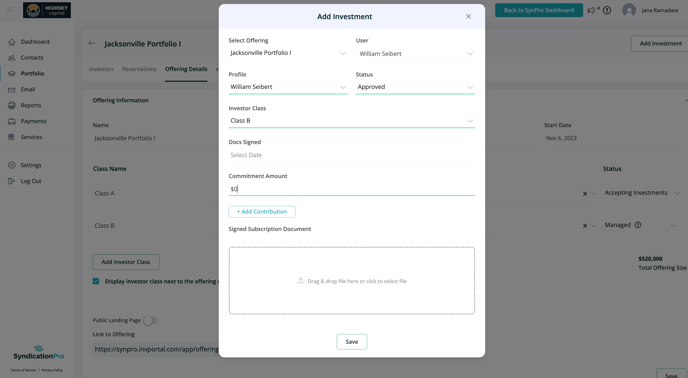

- Go to the Portfolio section and select the relevant Offering. Then, navigate to the Investments tab and click the "Add Investment" button in the top right corner.

- In the pop-up window, choose the General Partner (GP) as the user and select the appropriate GP Profile. If the GP does not appear, it likely means they are not listed in your contacts. In that case, go to Contacts, add them as a user, and create their profile.

- Set the Status to "Approved." If the sponsor hasn't made an investment, enter an investment amount of 0. Finally, click "Save" to finish the process.

- Once there, select the General Partner (GP) as the user and choose their corresponding GP Profile. Set the Status to "Approved." If the sponsor has not yet made an investment, you may enter an investment amount of 0. Finally, click "Save" to complete the process.

Add the Ownership Percentages for LPs and GPs

Steps to Add Ownership Percentage

-

Navigate to Portfolio > Offering > Distributions > Cap Table.

-

In the top summary section, click the Edit icon to add the overall ownership percentages for each class.

- If you're unsure about the percentage, we recommend using the final split after all hurdles are met.

- For instance, if Class A receives an 8% preferred return, followed by a full return of capital, and then the remaining distribution is 80% to Class A and 20% to Class B, you should enter 80% ownership for Class A and 20% ownership for Class B.

For additional information on how ownership percentages are applied in our Waterfall Calculation, please click here.