How to Verify an Investor's Accreditation in SyndicationPro

An Investor needs to meet specific SEC criteria regarding income, net worth, knowledge level, or affiliations under Rule 506(c) to become verified as an Accredited Investor.

SyndicationPro provides automated solutions to verify your investor’s accreditation within the platform.

Key Advantages

Our accreditation verification features bring the following benefits:

- Speed up the Investment process and reduce the time to onboard new Investors to 506(c) Deals.

- Reduce the investor drop-off rates due to wrong information input or expired accreditation letters.

- Lower the barrier to entry by making the verification process simple and easy.

- Manage and safeguard all Investor accreditation documents in one place and keep track of their expiration dates.

Step-by-Step Setup Guide

Step 1: Click on "Portfolio" from the main menu, and click on the Offering that requires investors to submit an accreditation letter.

Step 2: From the Offering click on the "Accreditations" tab and click "Settings".

Step 3: Click the toggle button to turn on the features you need, more on each feature below.

Option 1: Enable Automated Accreditation Verification via Parallel Markets (Additional Fees Apply)

This feature will allow investors to submit an application to our verification partner, Parallel Markets, to verify their accreditation. The investor can submit an application in less than 10 minutes during the investment process directly from your portal and then you and your investor will receive their accreditation letter automatically within 24-48 business hours.

We also give the investor an option to upload an existing letter. You’ll be notified if an investor uploads an existing letter for your review.

Pricing

- $500 one-time setup fee to activate, includes unlimited offerings

- $59 per Accreditation Letter via Parallel Markets

- $59 for renewing expired Accreditation Letters via Parallel Markets

Expiration of Accredited Letters

Generally, an accreditation letter expires after 90 days. The SEC has also provided guidance that an issuer can rely on an accreditation letter for future investments for up to 5 years. This applies to only the same issuer e.g. a company with multiple deals may be considered as a separate issuer altogether. Learn more

If you need an investor to provide proof of accreditation for more than one deal within 90 days then you will only be charged once. For example, if an investor invests with you in Offering A on Jan 15th and then invests with you in Offering B on Feb 15th, you will only be charged one time on Jan 15th. If they invest with you in Offering C on May 15th then you will be charged to access this new accreditation letter.

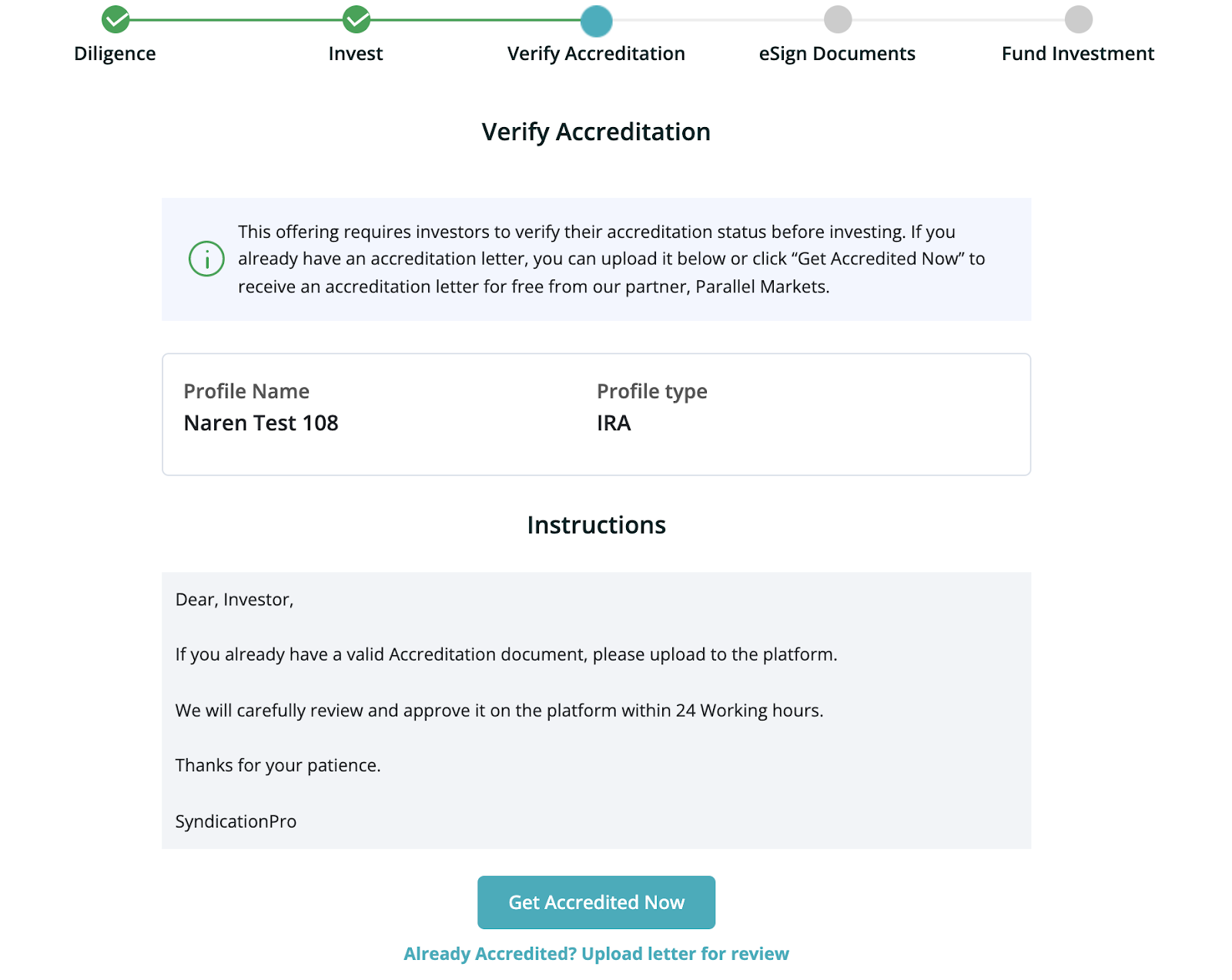

Option 2: Add Custom instructions for the investors

You can manually verify your investor’s accreditation by providing a custom message which will be displayed during the investment process. You can attach a document to the message and investors also have the option to upload documents during this step of the investment process or follow your instructions otherwise.

Once the toggle button is ON, you can add Custom instructions to make them visible to your investors.

Note: You can turn ON "Restrict eSign & Funding instructions only to accredited Investors" to restrict investors from advancing further to eSigning the subscription agreement or viewing the wiring instructions until their accreditation is verified.

Investor Accreditation Verification Workflow

The accreditation process is handled during the investment process.

If the "Automated Accreditation Verification via Parallel Markets" toggle is ON, investors will be presented with a "Get Accredited Now” button. They will still see the option to upload an existing letter if they have one.

The application takes less than 10 minutes for the investor to complete and will be processed within 24 to 48 business hours. Once the process is complete, both the sponsor and the investor will receive an email notification.

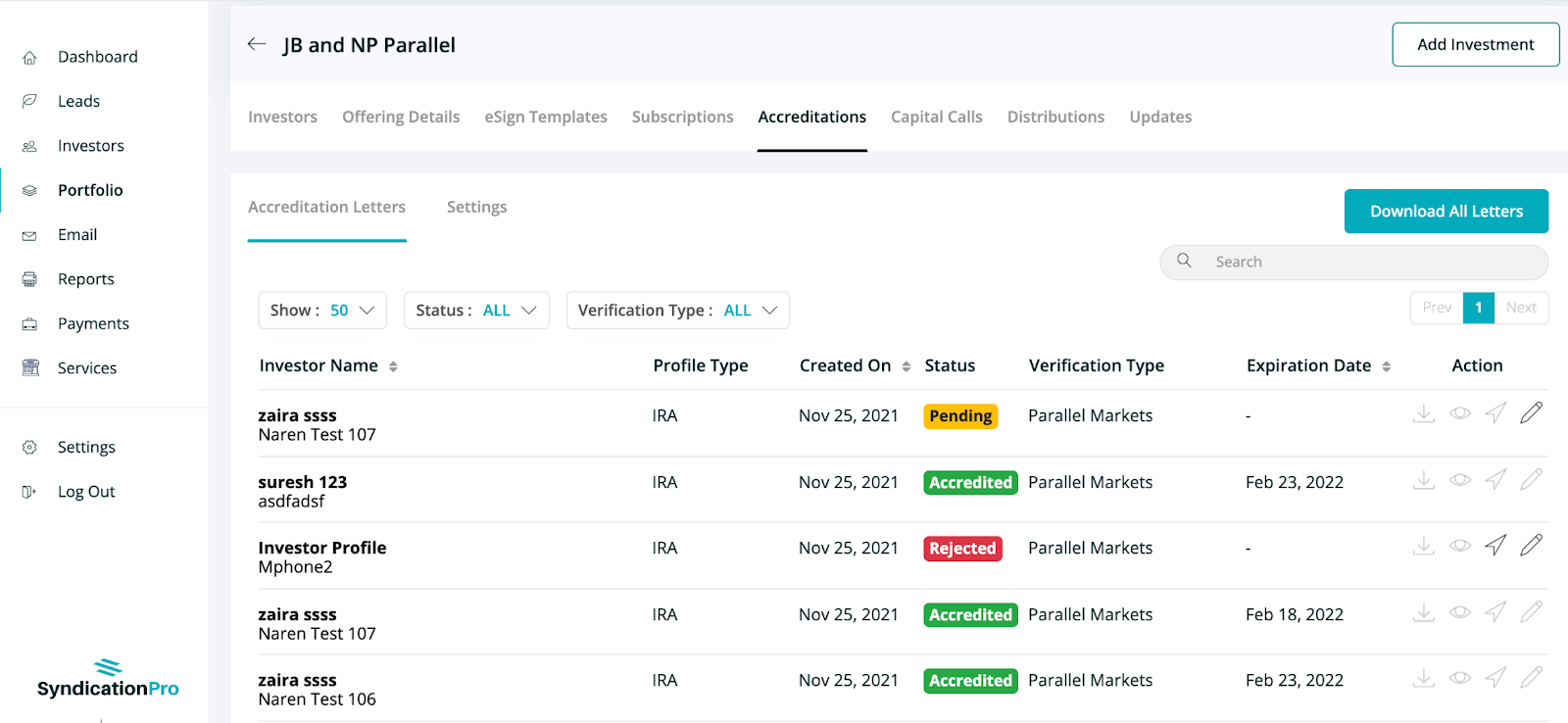

How to track Accreditation letters status or manually verify an investor’s accreditation.

All of the accreditation letters' status can be tracked and managed under each Offering > Accreditations > Accreditation Letters.

The verification Type will be displayed as Parallel Markets or Manual based upon whether the investor used Parallel Markets or manually uploaded a letter for your review.

You can approve/reject any accreditation request by clicking on the edit icon and changing the Accreditation status to Accredited or Rejected.

If the accreditation status is "Rejected," an email notification will be sent to the investor. You can send an email reminder to the investor to complete the verification by clicking on the plane icon.

The investor can also manage and track their accreditation status from their investor portal by clicking on Profiles > Accreditations.

If you have any inquiries regarding the Parallel Markets validation requirements process, you can access more information by clicking here. For additional questions, feel free to reach out to help@parallelmarkets.com.

👤 For questions or help with the process, email us at success@sponsorcloud.io or Schedule a meeting. An experienced Customer Success Manager will reach out to assist you.