A Deep Dive into Updated Investor Metrics

Our upgraded investor portal offers enhanced clarity and precision, featuring refined calculations to deliver a more accurate understanding of investment trends and performance

Brief Video Overview - New Investor Metrics

The My Investments page now includes several new metrics designed to provide deeper insights into investment performance:

-

Equity Multiple (EM)

Equity Multiple measures the total distributions relative to the total capital invested.

Formula:

EM = Total Distributions / Total Capital -

Accrued Preferred Return (Accrued Pref)

Accrued Pref represents the preferred return earned but not yet paid to investors. This will only be displayed if you have a waterfall setup with a preferred return. -

Annualized Cash on Cash (Annualized CoC)

This metric expresses the cash-on-cash return as a percentage, and annualized based on the duration of the investment. Cash-on-cash includes all types of distributions.

Formula:

Annualized CoC = (Total Distributions / Total Capital) / Years Invested -

Estimated Internal Rate of Return (Estimated IRR)

Estimated IRR calculates the time-weighted return by factoring in all distributions and treating the Net Asset Value (NAV) as the final sales amount. The equivalent spreadsheet formula is XIRR. -

Net Asset Value (NAV)

NAV represents how much your investor's position is worth if the offering is liquidated.

Formula:

Investor NAV = Latest Value of Investment Balance × % Funded -

Internal Rate of Return (IRR)

IRR is a time-weighted metric that evaluates the overall return on investment, incorporating all distributions. The equivalent spreadsheet formula is XIRR.

Manage Visibility of Metrics to the Investor Portal

The Sponsor has complete control over which investor metrics are visible, allowing them to hide or display relevant metrics. Follow the step-by-step instructions below to manage visibility.

- Navigate to Portfolio > The Offering > Distributions > Investor Metrics > Returns tab of the Offering.

- Select the desired Investor Class. If there are multiple classes, choose the one that is relevant.

- Choose the Start Date for the return calculations.

- If you select Funded Date, calculations will be based on the funded/contribution dates of the investments.

- If you select Override Date, the calculations will be based on the chosen date.

-

You can view each investor's calculated returns at the bottom of the page and choose to hide or display specific metrics according to your preferences by turning on and off the toggle buttons next to each metric.

All of the return metrics are calculated independently of the waterfall calculations, with the exceptions noted below:

- Accrued Pref will only be displayed if your waterfall setup includes a preferred return. Click here to learn more about our Waterfall calculator.

- Estimated Internal Rate of Return (IRR) will only appear if the Net Asset Value (NAV) is configured. (See below)

Add Net Asset Value (NAV) and Calculate Estimated Internal Rate of Return (IRR)

- Select the Net Asset Value tab.

Select the Class, Valuation Date and Investment Balance Value, then click Save.

The value of the investment balance is simply how much you would expect to pay out to investors if the offering were liquidated.

This will populate the NAV history graph. You can also adjust the visibility of this metric by selecting Show or Hide according to your preference.

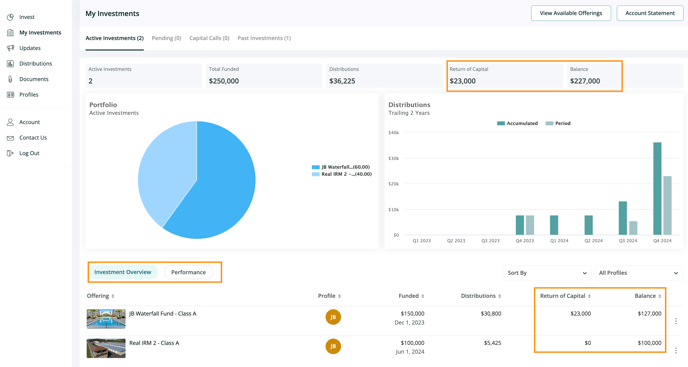

Investor Portal Enhancements

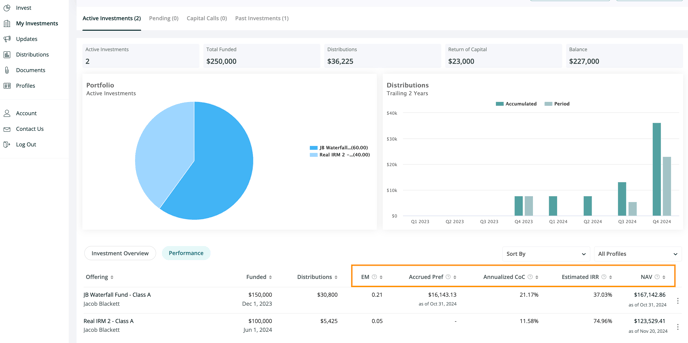

We have revamped the metrics at the top of the Active Investments tab and introduced a brand-new Performance tab. The Performance tab gives investors a clear perspective of how their investments are going.

Under the Investment Overview tab, we have added separate sections for Return of Capital and Balance, allowing for more effective tracking of distributions and Return of Capital individually.

The newly introduced Performance tab includes key performance metrics, such as Equity Multiple (EM), Accrued Preferred Return, Annualized Cash on Cash (CoC), Estimated IRR, and Net Asset Value (NAV).

👤 For questions or help with the process, email us at success@sponsorcloud.io or Schedule a meeting. An experienced Customer Success Manager will reach out to assist you.