Simplify the IRA Investment Process by Linking Your ETC Account

Discover how IRA investors can seamlessly connect their current ETC (Equity Trust Company) Account during the investment process for a streamlined and automated investment experience.

Intro

Equity Trust Company (ETC) and SyndicationPro have partnered to streamline self-directed IRA investments. Together, we are automating the entire business cycle ― from raising capital to investor relations, distributions, and more!

Step #1: Establish SyndicationPro as a New Account Relationship within Equity Trust Company.

Step 1: Add SyndicationPro to Your Equity Trust Account

To link your Equity Trust Company (ETC) account with SyndicationPro, you need to add us as an approved relationship. Here’s how:

Step 1: Go to www.myequity.com and log in using your username and password.

Step 2: Click on Profile in the top menu, then choose Account Relationships.

Step 3: Click Manage Interested Parties.

Step 4: At the bottom, select Add a New Relationship, and use the following details and hit Next to Agree the terms.

-

-

Relationship Type: Interested Party

-

Account: Choose the IRA account you’re using for the investment

-

Contact ID: 2769567

-

Once you submit, SyndicationPro will usually be added right away—but it can take up to 4 hours. To check if it worked, go back to Profile > Account Relationships. If you see SyndicationPro listed, you're all set and can move on to Step 2.

Step #2: Link the ETC Account with the Investor Profile

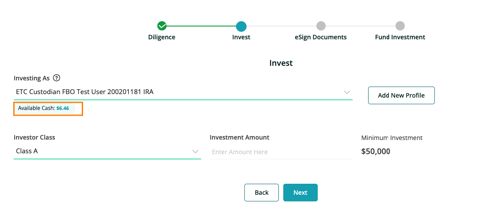

In Step 2, the INVEST phase of the Investment Process, the investor can create their preferred Investment Profile for the specific Investment.

Investors can follow the steps to Add New Profile and Link the ETC Account.

- Click

- Toggle the Link to ETC Account? to Yes

- Enter the ETC Account number

- Click

If successful, you will receive an "Account linked successfully" message.

Once the ETC Account is linked, SyndicationPro automatically syncs the IRA profile information with the Investor profile, making it readily available to proceed with the investment process.

- Available Cash in the Account to Invest

- IRA Profile Name, Address, Tax ID

- Preferred Distribution Method and IRA Bank account details.

- IRA notification email for investment updates

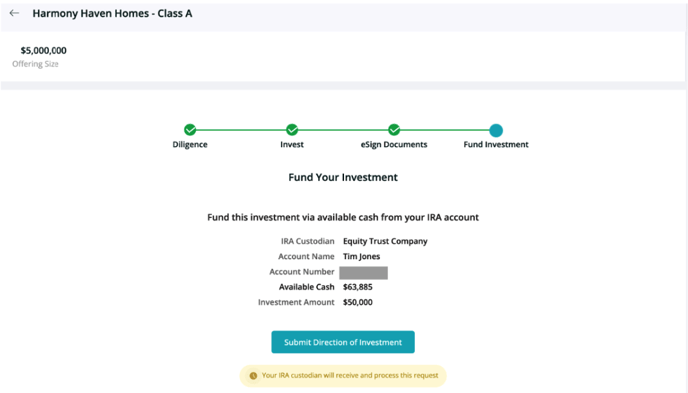

Step #3: Send the investment for approval to the IRA Custodian and fund transfer.

Once all the required steps in the Investment wizard are finished, investors can submit the Direction of Investment(DOI) to the ETC IRA custodian with a click of a button after reviewing the Investment Summary.

👤 For questions or help with the process, email us at success@sponsorcloud.io or Schedule a meeting. An experienced Customer Success Manager will reach out to assist you.

FAQ (Frequently Asked Questions)

What Happens When An ETC Account Is Linked?

- The Available Cash amount will be listed. You can click the

(refresh) icon to get the latest amount.

(refresh) icon to get the latest amount. - The IRA Name field on the Profile will be auto-populated to match the value as listed in the linked ETC account.

- For example, if the Investor's name is John Doe and their ETC account number is 12345678, then the IRA Name field will be set to "ETC Custodian FBO John Doe 12345678 IRA."

- The Profile Address fields will be auto-populated with ETC's address.

- The Distribution Method will be automatically set to ETC's bank account details for ACH, and ETC's physical address for Check.

- ETC's email address will be auto-populated in the Distribution Notification Email field.

Is it mandatory to link my ETC account with my IRA profile?

- No, it is not mandatory, but it is highly recommended that Investors who hold an ETC account link their ETC account to their IRA Profile. This ensures that the details are correct on the IRA Profile and that ETC does not run into any issues on the backend when reconciling the account.

- If an Investor does not have an ETC account, they can simply click Create New ETC Account and create the account from there.

Can Investors link their ETC account with an existing IRA Profile?

- Yes, Investors can link their ETC account to an existing IRA Profile by editing it and entering their ETC account number.

After the investor submits the investment request, how long will it take for ETC to complete the process?

-

- The timeframe for completing DOIs typically ranges from 3 to 5 business days, depending on whether ETC has previously approved the Offering.

Why is my DOI not completed by ETC after 5 business days?

Sometimes, the approval process for an Offering may take longer than expected as ETC collaborates with the Sponsor to gather and review the required documentation. ETC only accepts Directions of Investment (DOIs) for Assets (Offerings) that have been approved beforehand, which could potentially cause delays in the process.

How can I be informed when ETC has started funding for the DOI I submitted?

Once ETC initiates funding for the Direction of Investment (DOI), the Investor will be notified via email.