How to Track K1 Tax Documents

Learn how to efficiently upload and manage tax documents and notify Investors in SyndicationPro

Intro

SyndicationPro provides sponsors with two convenient options for uploading and managing tax documents. You can choose to upload documents in bulk for all investors or upload them directly from an Offering Level.

📝 Note: If you would like to learn more about easily uploading K1 Documents for investors in bulk, you can click here.

In this article, we will explore a method for effectively monitoring the status of tax documents for pending investors at the offering level. We will also cover how to upload tax documents and communicate with investors.

How to Access the Tax Document Tracker and Upload the Tax Documents

From your SyndicationPro dashboard, follow the below steps

- Click Contacts in the left-hand navigation menu and click on the Hamburger icon

located on the right side of the screen.

located on the right side of the screen. - Click Tax Document Tracker from the drop down.

- Once you click on "Tax Document Tracker," you will be directed to a page that displays the relevant offerings for the current tax year.

- On this page, you can easily monitor the status of tax documents. The status will either be "Pending" or "Completed," depending on whether there are still investors who need to receive their tax documents.

💡TIP: You can change the Tax Year by adjusting the filter. This allows you to track tax document statuses for different tax years.

How to Upload the Tax Document Specific to an Investor

.gif?width=688&height=387&name=main_large%20(1).gif)

- To view the list of eligible investors who need tax documents for a specific offering, click on the arrow located under the "Actions" tab next to the offering. This will provide you with a comprehensive overview of all eligible investors to receive their tax documents.

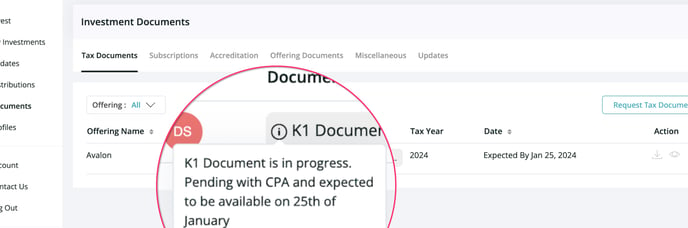

- If the K1 document is available, you can easily upload it by clicking on the upload icon next to each investor. In case the document is not yet available, you can update the expected date and send a personalized note to the investor through the platform. The expected date and personal note will also be visible to investors under Documents > Tax Documents.

- Once all investors for a particular offering have been uploaded with their K1 documents, the status will automatically change to "Completed."

- Additionally, you have the convenience of bulk uploading K1 documents to all the investors associated with an offering. SyndicationPro will then automatically match the documents to each investor based on their Tax ID or Full Name, depending on the conditions you have chosen.

.gif?width=688&height=387&name=main_large%20(2).gif)

💡 Tip: For detailed instructions on how to bulk upload K1 documents and auto-match the documents to investor accounts, please click here to learn more.

How Investors Can Request Tax Documents from Sponsors

In addition to sponsors being able to track and upload tax documents, investors also have the option to request K1 documents through SyndicationPro.

.gif?width=688&height=340&name=main_large%20(3).gif)

Steps for Investors to Request Tax Documents:

To request tax documents through SyndicationPro, Investors must follow these simple steps:

- Go to your SyndicationPro Investor dashboard.

- Click on "Documents" in the left-hand navigation menu.

- From the top panel, select "Tax Documents" and click on "Request Tax Document."

- Fill in the required information, including your profile name, tax year, and offering name.

- Click on "Request" to submit your request.

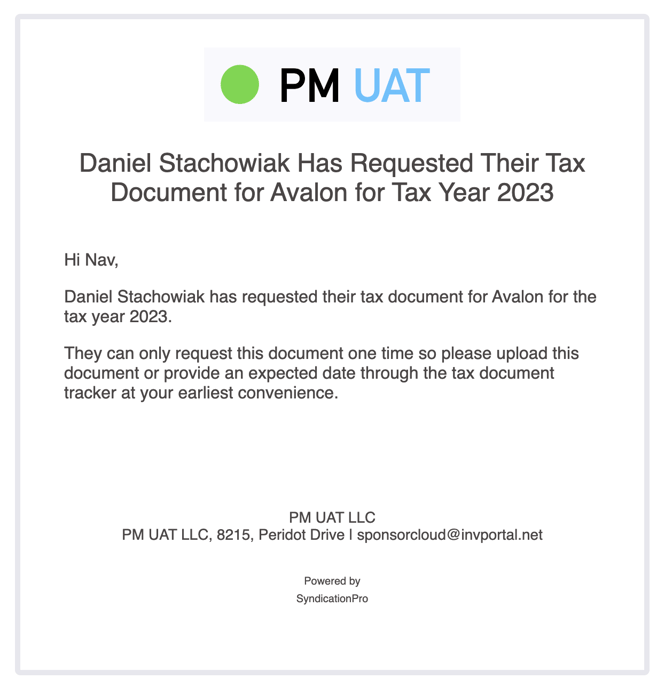

- Once you submit the Request, an email will be automatically sent notifying the sponsor.

💡HINT:

Sample Email Notification Sent to Sponsors When Investors Request Tax Documents

👤 For questions or help with the process, email us at success@sponsorcloud.io or Schedule a meeting. An experienced Customer Success Manager will reach out to assist you.

FAQs

🙋 Will Cosponsors be able to add documents through the tax document tracker?

No, Cosponsors will not be able to add documents through the tax document tracker. Only the lead sponsor will have the ability to add documents, as well as expected dates.

🙋 Will the expected date be shown to investors if the offering is manually marked as completed?

No, expected dates are not shown for completed offerings.